jefferson parish property tax assessment

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Tax Records Could Offer Surprisingly Rich Details About Your Ancestors Genealogy Resources Family History Quotes Genealogy Help

The preliminary roll is subject to change.

. Property values are assessed through the Jefferson Parish Assessors Office. The Jefferson Davis Parish Assessor is responsible for discovery listing and valuing all property in the Parish for ad valorem tax purposes. Once the preliminary roll has been approved by the Louisiana Tax Commission the 2020 assessments will be updated on the website.

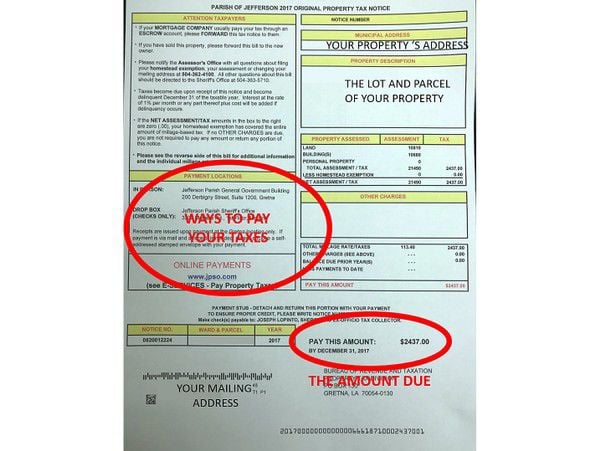

The Jefferson Parish Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Jefferson Parish. Millage Rate for this example we use the 2018 millage rate for Ward 82 the Metairie area x11340. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

The median property tax on a 17510000 house is 31518 in Louisiana. 1233 Westbank Expressway Harvey. Once the preliminary roll has been approved by the Louisiana Tax Commission the 2020 assessments will be updated on the website.

The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. Inventory is assessed at 15 of the monthly average. Name A - Z Ad Optima Tax Relief.

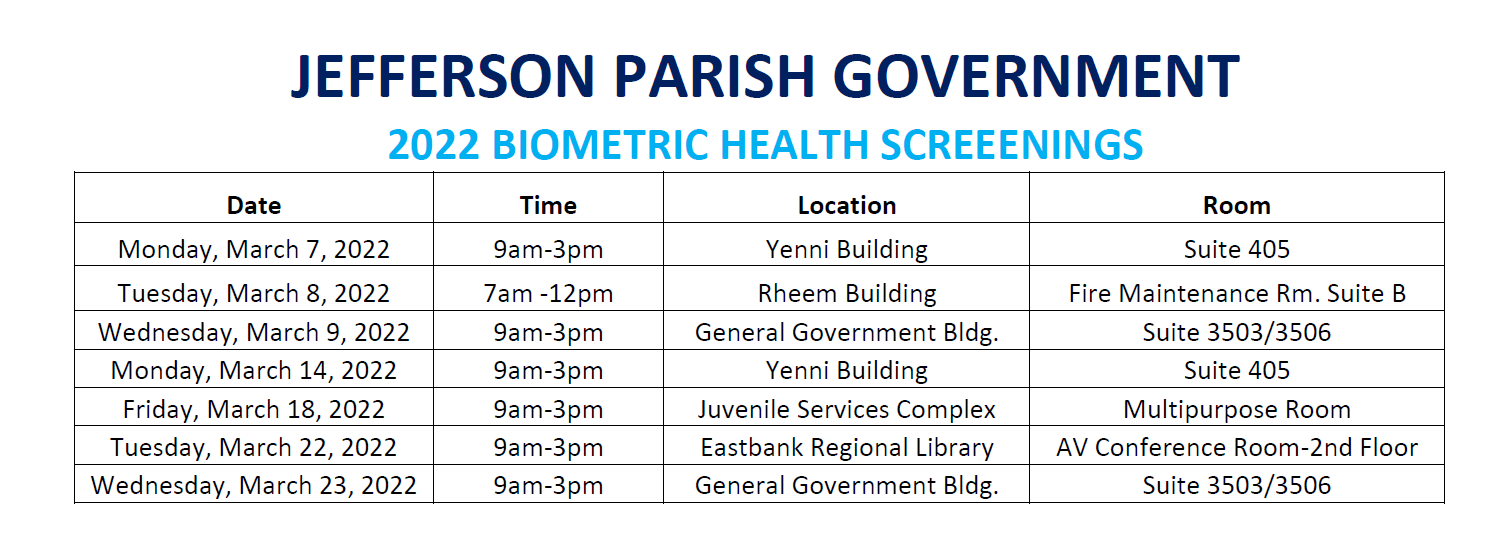

Jefferson parish collects on average 043 of a propertys assessed fair market value as property tax. Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes View Pay Water Bill. Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website.

Lopinto III as the Ex-Officio Tax Collector of Jefferson Parish will begin printing the 2020 property tax notices to Jefferson Parish residents and businesses by Monday December 7 2020. The preliminary roll is subject to change. Louisiana is ranked 1929th of the 3143 counties in the United States in order of the median amount of property taxes collected.

The Jefferson County PVA is responsible for applying a fair and equitable assessment to over 260000 residential properties in Jefferson County as of January 1st of each year. The median property tax on a 17510000 house is 75293 in Jefferson Parish. You may pay at our office located at 729 Maple Street Hillsboro MO 63050 online at Jefferson County Property Taxes or by Interactive Voice Response by calling 877-690-3729 if paying by IVR you will need to know your bill number and the Jefferson County Jurisdiction code 3515.

Income Tax Rate Indonesia. Rs Property Tax Services. The total number of parcels both commercial and residential is 185245.

Property Tax Calculation Sample. Other personal property is depreciated according to guidelines set by the state of Louisiana. When and how is my Personal Property assessed and calculated.

The assessment date is the first day of January of each year. The following local sales tax rates apply in jefferson parish. How is property tax calculated in Louisiana.

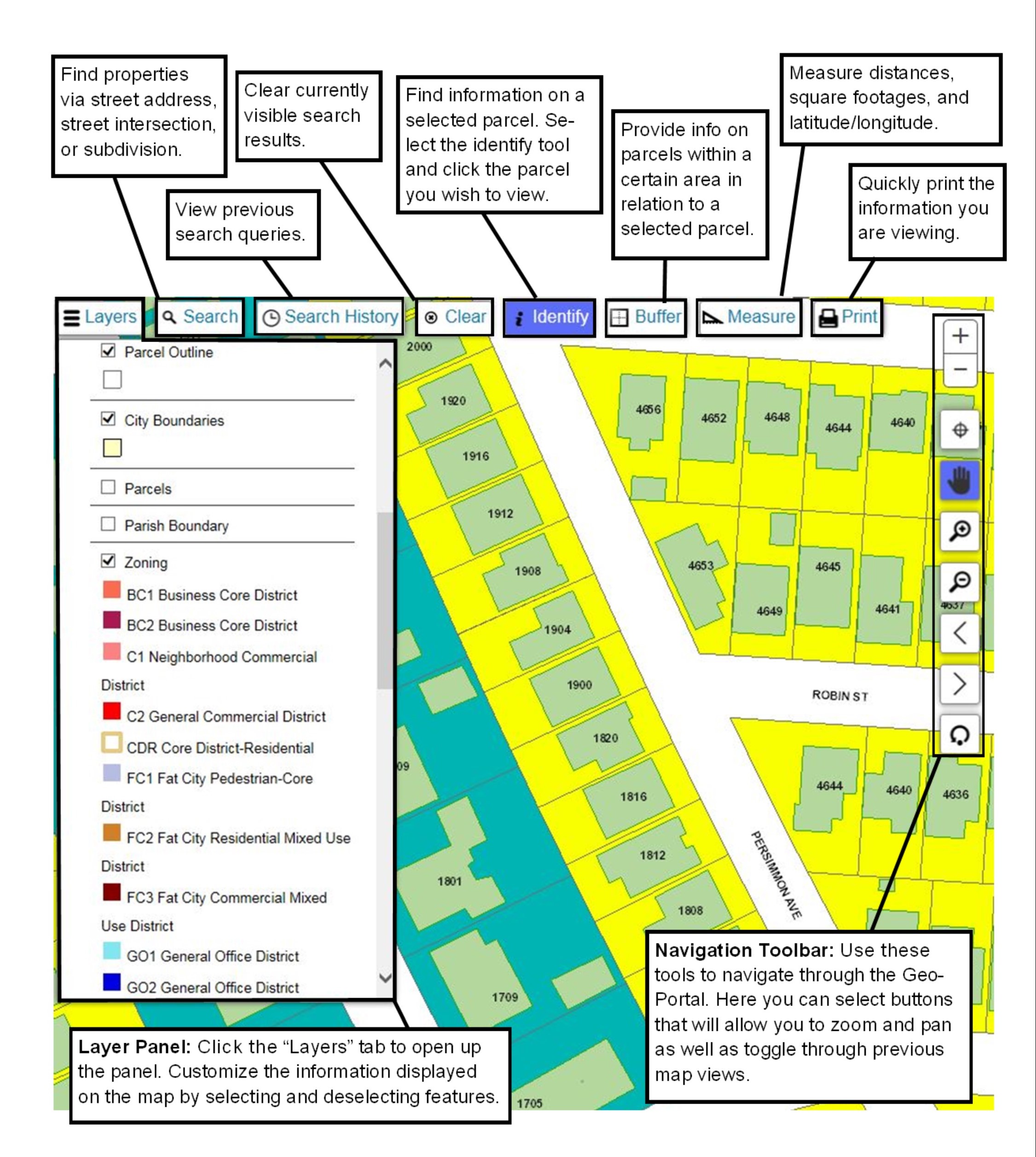

Jefferson Parish Assessors Office - Property Search. Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible. Taxed Value 12500.

For residential property in Louisiana assessed value is equal to 10 of market value. Property taxes for 2020 become due upon receipt of the tax notice. How do I pay my Jefferson County personal property tax.

Taxes-Consultants Representatives 2 More Info. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Jefferson Parish Tax Appraisers office. Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax.

Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website. Jefferson Parish LAT-5 forms are due 45 days after receipt. The preliminary roll is subject to change.

Property tax bills may be remitted via mail hand-delivery or paid online at our website. Jefferson Parish Permits 400 Maple Avenue Harvey LA 70058 504-364-3512 Directions. Property Taxes in Jefferson Parish LA.

Payments are processed immediately but may not be reflected for up to 5 business days. Administration Mon-Fri 800 am-400 pm Phone. If your homesteadmortgage company usually pays your property taxes please forward the tax notice to them for payment.

The Jefferson Parish Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax. Jefferson Parish Permits 3300 Metairie Road Metairie LA 70001 504-832-2399 Directions. This website will assist you in locating property ownerships assessed values legal descriptions estimated tax amounts and other helpful information that pertain to the Assessors office.

1233 Westbank Expressway Harvey LA 70058. Get Property Records from 8 Building Departments in Jefferson Parish LA. So if your home has a market value of 100000 your assessed value would be 10000.

The Jefferson Parish Assessors Office located in Gretna Louisiana determines the value of all taxable property in Jefferson Parish LA. Please note that the City of Gretna does not offer a homestead exemption for property taxes specific to the Citys jurisdiction. Online Property Tax System.

The Jefferson Parish Assessors Office determines the taxable assessment of property. Welcome to the Jefferson Parish Assessors office. The telephone number is 504-363-5710.

Property Maintenance Zoning Quality of Life. Jefferson Parish Assessors Office - Property Search. Jefferson Parish Tax Assessor Map.

Market Value 200000. Serving the Jefferson Parish area. Property assessments performed by the Assessor are.

This property includes all real estate all business movable property personal property and all oil gas property and equipment. Once a propertys market value has been determined the assessment percentage is applied. Assessed Value 20000.

YEARS WITH 800 910-9619. Its duties also include organizing and directing annual tax sales. The Property Tax Divisions primary function is to collect property taxes on real estate and moveable property based on the assessed value as determined by the Jefferson Parish Assessors Office.

If not property taxes may be paid through several other methods. Commercial Property The Jefferson County PVA is responsible for applying a fair and equitable assessment to over 21000 commercial properties in Jefferson County as of. A convenience fee of 249 is assessed for credit card payments.

Property Taxes in Jefferson Parish LA. Due to the Annual Tax Sale this site can only be used to view andor order a tax research certificate. Jefferson Parish Permits 822 South Clearview Parkway Elmwood LA 70123 504-736-7345 Directions.

Free jefferson parish property records search. Assessed value is the Taxed value if no Homestead Exemption is in place. You can call the Jefferson Parish Tax Assessors Office for assistance at 504-362-4100.

Jefferson Parish Sheriffs Office. Our office is open for business from 830 am. Please contact the Jefferson Parish Sheriff 504-363-5710 for payment options.

Homestead Exemption Deduction if applicable-7500.

Tax Assessment Reductions Available To Some Property Owners

Property Tax Overview Jefferson Parish Sheriff La Official Website

Tax Records Could Offer Surprisingly Rich Details About Your Ancestors Genealogy Resources Genealogy Help Family History

St Tammany Parish Sheriff 008 Parish Police Cars Sheriff

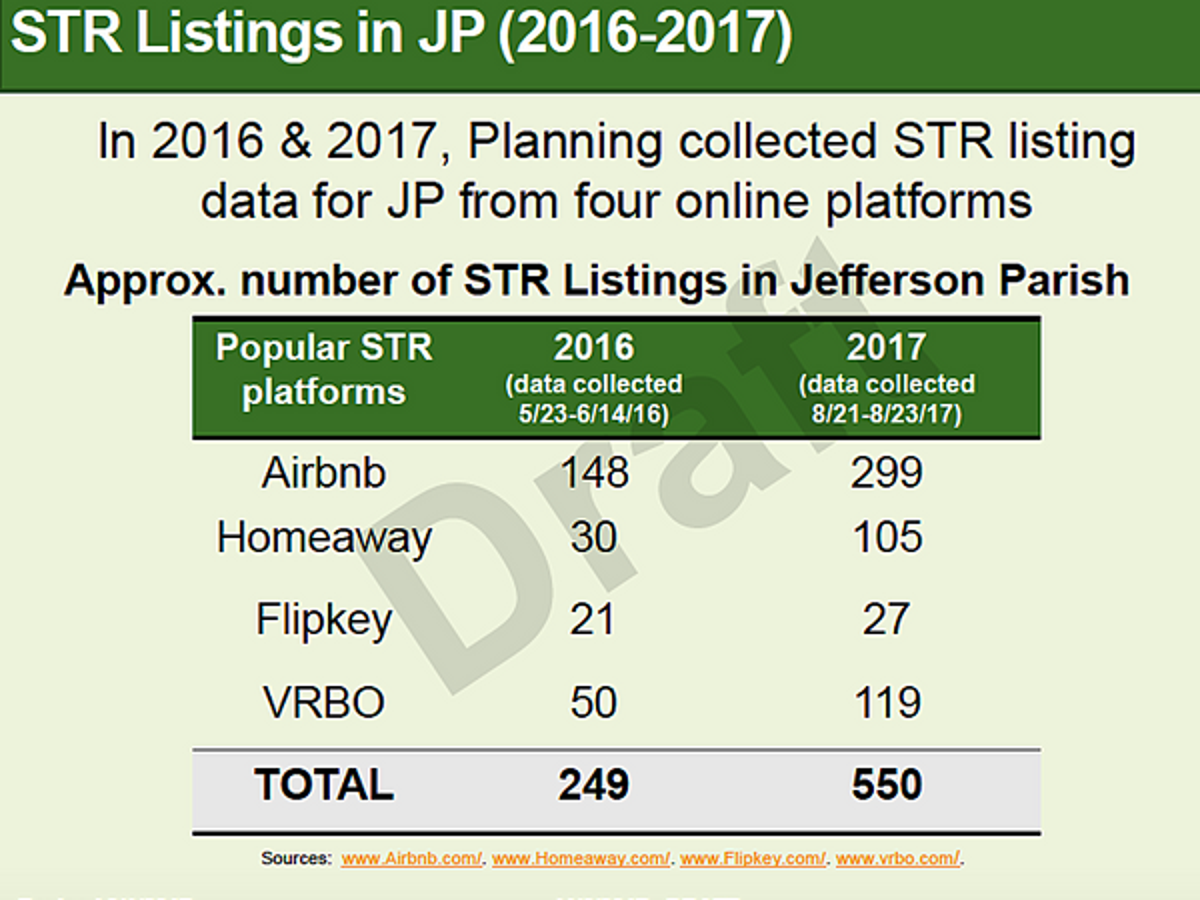

Extra Income Or Neighborhood Nuisance Short Term Rental Rules Weighed In Jefferson Parish Local Politics Nola Com

St Tammany Parish Sheriff 005 Police Cars Emergency Vehicles Sheriff

Property Tax Overview Jefferson Parish Sheriff La Official Website

Two Apartment Projects Proposed For Sylva Multifamily Https Www Smokymountainnews Com News Item 310 Sylva Multifamily Property Management Apartment Projects

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

What Jp Residents Need To Know To Pay Property Tax

St Tammany Parish Sheriff 007 Sheriff Office Sheriff Police Cars

Property Tax Overview Jefferson Parish Sheriff La Official Website

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com