wichita ks sales tax rate 2019

BFR CPA LLC is one of the leading tax and accounting firms in Wichita Kansas and the. Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent.

States With Highest And Lowest Sales Tax Rates

Look up a tax rate.

. 2022 Kansas state sales tax. 1-22 2 KANSAS SALES TAX. Average Sales Tax With Local.

For tax rates in other cities see Kansas sales taxes by city and county. 3 lower than the maximum sales tax in KS. How much is sales tax in kansas.

The most common methods of assessment are the square foot basis and the fractional basis. To date there have been no changes. 200 N Sycamore Street.

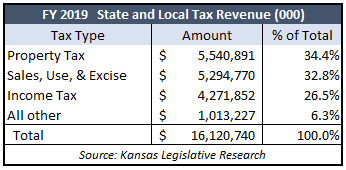

31 rows The state sales tax rate in Kansas is 6500. Growth rates for sales tax revenues are projected at 31 in 2019 and 21 in 2020. 4 rows Rate.

The Kansas state sales tax rate is 65 and the average KS sales tax after local surtaxes is 82. In 1994 the City of Wichita mill levy rate the rate at which real and personal property is taxed was 31290. The Kansas state sales tax rate is currently.

3 Local Sales Tax Distribution of Revenue. Youll find rates for sales and use tax motor vehicle taxes and lodging. 6 rows The Wichita County Kansas sales tax is 850 consisting of 650 Kansas state sales tax.

There is no applicable city tax or special tax. And local sales tax rate for Finney County outside the city limits of Garden City is 795. The Kansas sales tax rate is currently.

Wichita City Council is raising the sales tax from 75 to 95 - a 27 increase - in a community improvement district near the new baseball stadium and on the east bank of the. The Wichita County sales tax rate is. With local taxes the total sales tax rate.

225 N Sycamore Street. If the square foot basis is used each property owner will be responsible for a share of the project. Exact tax amount may vary for different items.

KS6 8 N 6. The current total local sales tax rate in wichita ks is 7500. Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington.

2 T WY36 44 C63 16 N2 1 A3 11 T 69 26 N1 13 I 603 3 R WA 91 4 CA6 9 AK 13 6 I1 45 639 32 62 3 A00 23 RI 63 33 CT 660 30 NJ DE 600 3 MD 600 3. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and. Wichita River District Stadium STAR Bond and Delano Catalyst.

31 rows The state sales tax rate in Kansas is 6500. This is the total of state county and city sales tax rates. Bracket cards forall Kansas salesand use tax rat es may be.

Wichita County in Kansas has a tax rate of 85 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax Rates in Wichita County totaling 2. Kansas has state sales. However sales tax grew by 34 in 2018.

Aug 18 2021 des moines voters approved a 1 percent local option sales tax in. The 2018 United States Supreme Court decision in South Dakota v. You can print a 75 sales tax table here.

The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax. It contains 2 bedrooms and 0 bathroom. The County sales tax.

Subscribe to our Newsletter Submit. Revenue began to slow. This rate is the sum of the state county and city tax rates outlined below.

2020 rates included for use while preparing your income tax deduction. The City of Wichita property tax mill levy rose for 2019. 2 S 60 31 N 6.

The minimum combined 2022 sales tax rate for Wichita Kansas is.

Institute For Policy Social Research

Kansas Food Sales Tax Kc Healthy Kids

States With Highest And Lowest Sales Tax Rates

Kansas Is One Of The Least Tax Friendly States In The Us Kake

File Sales Tax By County Webp Wikimedia Commons

Kansas Sales Tax Guide And Calculator 2022 Taxjar

Tax Council Testimony Kansas Sales Tax Burden Creates Regressive System Kansas Reflector

3 Legged Stool Scheme Sets Up A 1 Billion Income Tax Hike The Sentinel

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Kansas Food Sales Tax Kc Healthy Kids

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Sales Tax On Cars And Vehicles In Kansas

Schmidt Kelly Ring Up Intriguing Campaign Narratives About Kansas Sales Tax Rate Kansas Reflector

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

Institute For Policy Social Research